When

mathematical theory is the ultimate arbiter of truth, it becomes

difficult to see the difference between science and pseudoscience

I have watached the struggle between reival economic claims during this referendum. The more I see it the more I am reminded of the similarity between 16th Century Astrology and Economic Theory

If

overhauling economics depended solely on economists, then conflict

of interest and cost bias could easily prove insurmountable.

Fortunately, non-experts also participate in the market for economic

theory. If people remain enchanted by the the production of

complicated mathematical theories, those theories will remain

valuable. If they become disenchanted, the value will drop.

Economists

who rationalise their discipline’s value can be convincing,

especially with prestige and exactness on their side. But there’s

no reason to keep believing them. The pejorative verb ‘rationalise’

itself warns of mathematical bias, reminding us that we often deceive

each other by making prior convictions, biases and ideological

positions look ‘rational’, a word that confuses truth with

mathematical reasoning. To be rational is, simply, to think in

ratios, like the ratios that govern the geometry of the stars. Yet

when mathematical theory is the ultimate arbiter of truth, it becomes

difficult to see the difference between science and pseudoscience.

The

result is people like the Son of Heaven in ancient China, who trust

the mathematical exactitude of theories without considering their

performance – that is, who confuse mathrmatics with science,

rationality with reality.

There

is no longer any excuse for making the same mistake with economic

theory. For more than a century, the public has been warned, and the

way forward is clear. It’s time to stop wasting our money and

recognise the high priests of the religion 0f austerity or the

Brexiteers for what they really are: gifted manipulators of

empiricism who excel at producing mathematical explanations of

economies, but who fail, like 16th Century astrologers

before them, at prophecy.Does this not sound like economic theory be honest.........

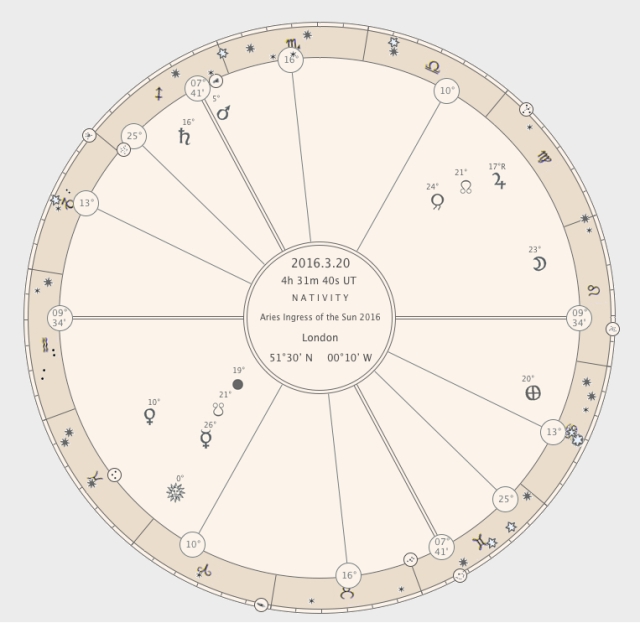

On 20 March 2016 at 4:30 UT the Sun will be in 00*00’ Aries. Traditional astrology states that a chart cast for the capital of a nation at the time the Sun enters Aries provides a detailed picture of the events occurring during the year or at least part of the year to follow. The ancients called this the Revolution of the Year of the World, but it is also known as the solar ingress.

As ingress charts are location specific, I will give a separate analysis of the 2016 solar ingress chart for Britain and the EU, followed by the ingress chart of the Unites States of America.

2016 Solar Ingress for the United Kingdom

Shown above is the Aries ingress chart, cast for London, representing the United Kingdom. With a fixed sign rising, this chart will be valid for the whole solar year, until the Sun’s Aries ingress in 2017.

From the chart above, we can see that Mars will be the Lord of the Year. He is Lord of the 9th house, and is prominently positioned near the 10th house cusp (MC). Generally speaking, this suggests that the main themes during this solar year will be matters concerning conflicts, arguments and divisions. Bonatti writes that Mars in the 10th house:

“… signifies wars and contentions over matters which do not belong to those who seek them, nor pertain to them” (BoA p951)*.

In the light of the British prime minister’s recent negotiations with leaders within the European Union and the prospect of a referendum on 23 June, possibly resulting in Britain’s exit from the EU (the so called “Brexit”), Bonatti’s delineations seems to be ominously succinct. We have to keep in mind also,

“that by the Lord of the Year is known the condition of the whole nation, people, and indeed everything therein in a general way…”(AR p344)**.

Mars’ domicile in the 9th house and his conjunction with the medium coeli do suggest that the future of Britain’s economy will truly be on everybody’s mind. This shows that the two camps, arguing for or against a Brexit, will push their agenda religiously, if not fanatically. Looking at the state of Mercury, natural significator of the economy, we can see that potential danger is lurking here (Mercury, under the sunbeams, is essentially debilitated by detriment and fall).

A quick look at the Aries ingress chart for Brussels, representative for the European Union, shows that, at face value, it is identical to the ingress chart for the UK. Aquarius is rising here too, and therefore both charts are valid for one year. A closer look reveals though, that, unlike in the case of the UK, the ruler of the year for the EU is the Moon, natural significator of the common people, or the collective of the many. This can be interpreted as a first sign of the eventual rift between the EU and the UK. Aggressively, Mars (Lord of the Year for the UK) tries to break away from the EU, symbolised by the Moon.

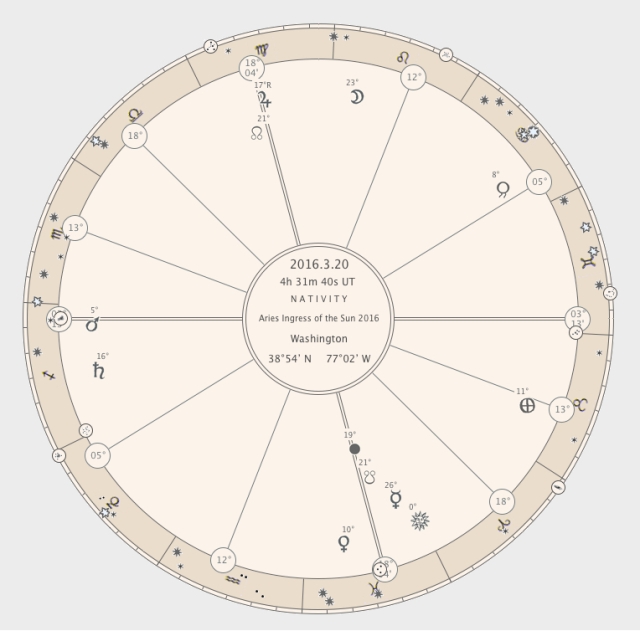

2016 Solar Ingress for the United States of America

Shown above is the Aries ingress chart, cast for Washington and therefore representative for the United States of America. With a mutable sign rising, this chart is valid for six months and the Libra ingress chart will have to be taken into account thereafter.

During this year, much attention will be paid to the election campaign which will result in the US Presidential Elections, held on 8 November. We have to carefully distinguish between the election campaign, which is reflected in this chart, and the actual election itself, which will take place after the Sun’s ingress into Libra. The Libra ingress chart will have to be consulted to judge who will win the election and become president.

From the chart above, we can see that Mars will be Lord of the Revolution, which gives a first indication of what can be expected from the election campaign. Bonatti writes about Mars being Lord of the Revolution in the 1st house, that:

“… it signifies something horrible (and sorrow and fears, and contrarieties and contentions) is going to come to men …” (BoA p948)

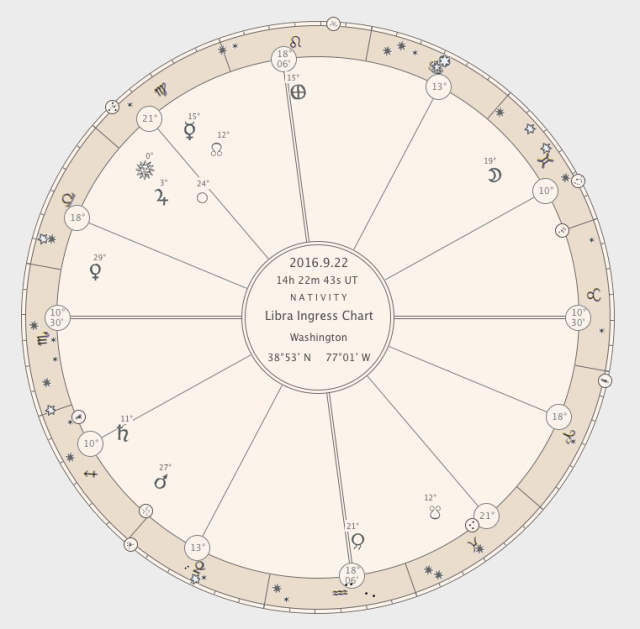

Below is the chart of the Libra ingress, cast for Washington, valid from 22 September 2016.

From a first glance at the Libra ingress chart, it looks to me as if the Democrats should be able to secure another victory. A detailed analysis of the ingress cart and a prediction of Brexit. or Indeed this from wikipedia...see the structure how similar they are

Theoretical considerations[edit]

Main article: New Keynesian economics

In the 1930s during the Great Depression, anti-austerity arguments gained more prominence. John Maynard Keynesbecame a well known anti-austerity economist,[8] arguing that "The boom, not the slump, is the right time for austerity at the Treasury."

Contemporary Keynesian and New Keynesian economists argue that budget deficits are appropriate when an economy is in recession, to reduce unemployment and help spur GDP growth.[10] According to Paul Krugman, since a government is not like a household, reductions in government spending during economic downturns worsen the crisis.[11]

Across an economy, one person's spending is another person's income. In other words, if everyone is trying to reduce their spending, the economy can be trapped in what economists call the paradox of thrift, worsening the recession as GDP falls.

If the private sector is unable or unwilling to consume at a level that increases GDP and employment sufficiently, Krugman argues, the government should be spending more in order to offset the decline in private spending.[11]

An important component of economic output is business investment, but there is no reason to expect it to stabilize at full utilization of the economy's resources.[12] High business profits do not necessarily lead to increased economic growth. (When businesses and banks have a disincentive to spend accumulated capital, such as cash repatriation taxes from profits in overseas tax havens and interest on excess reserves paid to banks, increased profits can lead to decreasing growth.)[13][14]

Economists Kenneth S. Rogoff and Carmen M. Reinhart wrote in April 2013, "Austerity seldom works without structural reforms – for example, changes in taxes, regulations and labor market policies – and if poorly designed, can disproportionately hit the poor and middle class. Our consistent advice has been to avoid withdrawing fiscal stimulus too quickly, a position identical to that of most mainstream economists."

To help improve the U.S. economy, they advocated reductions in mortgage principal for 'underwater homes'- those whose negative equity (where the value of the asset is less than the mortgage principal) can lead to a stagnant housing market with no realistic opportunity to reduce private debts).[15]

No comments:

Post a Comment